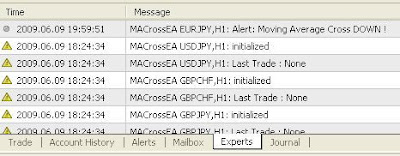

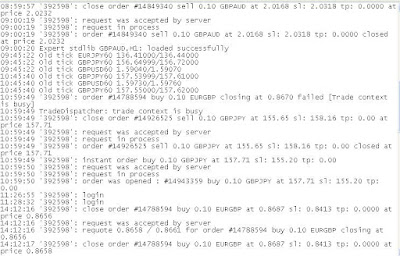

The week is coming to a close (already!). It started off (mon, tue, wed) with strong trending, then yesterday and today (thu, fri) we had some whipsaws in some pairs, maybe due to some news about the upcoming G8 meeting this week-end ? All in all, here is our winner for the week, GBPJPY at +400 and our loser for the week (in terms of open trades) GBPUSD currently at –115 (but closed at +231 earlier) along with GBPCHF at -29. You can see gbpusd whipsawed.

EURGBP is also still showing good strength at close to +200 and USDCHF which came close to crossing but continued its down-movement, currently at +35. GBPAUD fooled around a bit on Wednesday and Thursday, but seems to be back on track at +58.

Some of you are trading just one pair, others a few pairs and others all pairs. The important thing is to keep all pairs going in your observation platforms. Since you’ve got 10 pairs showing you if they’re biased one way or the other, you’re benefiting from diversification which is as important in forex as elsewhere. This also helps in developing an eye for correlations and influences by some pairs on others and can enlighten your decisions about exits or moving SLs.

I wish all a peaceful week-end and hope to see you back Sunday evening !