July 10, 2009

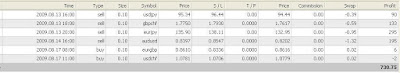

Another beautiful trading week comes to an end as we finish once again in nice profit.

People sometimes wonder about the question I put up there, and I’d like to write a bit about this. This applies to any trading system, not just the one we’re trading here.

Now, there are 2 aspects to stop losses:

1. You place a stop loss in case the market goes against your trade. It eventually gets hit. You take the loss with dignity. You were wrong, period (it happens). You accept this fact.

2. No sooner than seconds after you’ve just told yourself the above, the market turns back in your direction and (a) not only brings the price back to where you entered (you would have now been break-even) but even more insulting, (b) it goes past your entry ! (you would now be into profit).

So not only did you take a loss, you also LOST an opportunity to make this potential profit which is now staring you in the face. Everybody should hate stop losses!!!

After a few times of being humiliated (not to mention ROBBED), you decide that next time, you simply WON’T put a stop loss and just take the drawdown until it comes back, since it seems it always does, you might even take another trade in the same direction to “cost average”.

But guess what? THIS TIME, it never comes back. And had you put a SL, you would have been taken out at, say –80 where now you’re looking at a double loss now totalling –663 and your margin is shrinking fast…

Others will place very small stop losses thinking they won’t hurt cause they’ll be so small. Problem here is they’ll constantly get hit by wicks or fast market movements.

So what to do about stop losses? Well, for our system, we’ve got stop losses on all our pairs which I have optimized, as you know. Once a trade is in profit in your account, you can then adjust the stop loss to your liking. The initial SLs are there more as protection for what I wrote in this forum some time ago:

About the question of using SLs (Stop Losses) or not, it all depends on your strategy, of course, but I would advise to ALWAYS put one, even it it's very far, because the following can happen:

1. You lose power due to all sorts of reasons for a long period

2. You lose your internet connection for a long period

3. Your broker disconnects for lengthy periods of time4. Your computer dies on you and it takes 3 days to get it repaired and you live in a remote area where you don't have easy access to another computer.

5. You are the victim of a natural catastrophe (big storm, earthquake, flood) and can't access your account for a long period

Being in a trade which goes against you and not being able to access your account is no fun, but being in this situation and NOT HAVING A STOP LOSS in place will make matters much worse. So, just put one to make sure you don't lose your shirt. We never know what can happen.

I didn’t come up with the idea, I had read it in a forum myself a few years ago and I still believe it’s good advice. You’ll do whatever you want in your account, because it’s YOUR account. But remember we never know what can happen. I live in a very quiet place, not a “danger” area at all but in the last decade we’ve had a major earthquake AND a major flood (these things happen like once in every 100,000 years here) but see they did happen. So please, think about it if you’re inclined to not put stop losses.

Hey HAVE A GREAT WEEK-END EVERYONE thanks for all your nice emails/comments and SEE YOU AT MARKET OPEN !!!!